Unsecured debt consolidation loans for poor credit

0-6 Months 7-12 Months 1-3 Years 3 Years Time in Business. Upstart offers unsecured personal loans for debt consolidation to consumers who have little credit history but a regular income.

9 Guaranteed Debt Consolidation Loans For Bad Credit 2022 Badcredit Org

Even people with very poor credit can still.

. A few examples of unsecured personal loans include credit cards and some personal and business loans. Learn how it works if it is right for you. Unsecured debt consolidation Loans - The unsecured debt consolidation loans merge all obligations in one loan with one instalment at a fixed rate.

Does not handle IRS utility federal student loans or mortgage debt. If you have a poor credit history it can feel like the financial world is closed to you. It specializes in helping consumers saddled with credit card or medical debt but it also handles other types of unsecured loan debt including commercial student loan debt.

Debt consolidation is one of the most common reasons for taking out a personal loan. Long-term program to relieve debt over 24-48 month period. Why we help people with bad credit get debt consolidation loans.

If you have good or excellent credit you might consider Axos Bank which offers unsecured loans and a variety of terms. Requires 10000 or more in credit card debt. 3000 - 25000 25000 - 50000 50000 - 75000 75000 - 150000 150000 Desired Loan Amount Select.

The basic nature of the loans is friendly to the poor credit situation and anyone who wants to borrow can find instant financial relief. Since there is collateral as insurance that the loan will be paid the interest rates on unsecured loans are typically much higher than those you find attached to secure loans such as the mortgage of a home in which the house is collateral or. A few examples of unsecured personal loans include credit cards and some personal and business loans.

Nonbanks Fill Demand from Borrowers with Poor Credit April 25 2018. As a result they carry a higher risk for the lender and higher interest rates for the borrower. Founded in 2014 the lender is one of our top picks for debt consolidation.

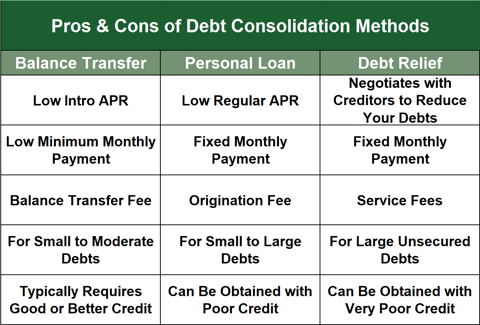

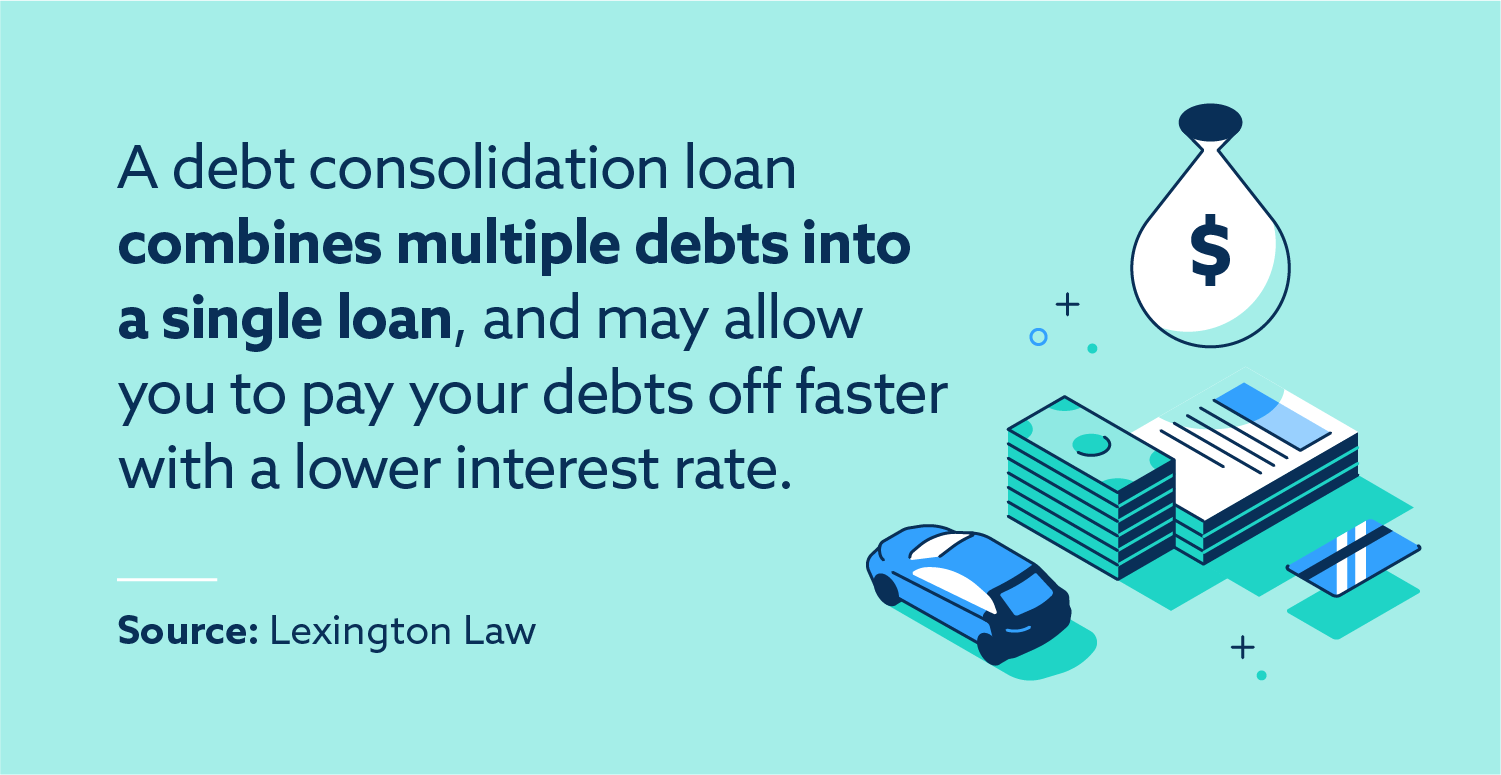

A consolidation loan is used to simplify your finances by combining multiple bills for credit cards into a single debt repaid with one monthly payment. Consolidation loans are just another name for unsecured personal loans. FHA Steps in to Help Nursing Homes by Backing Mortgages February 1 2013.

Bad credit loans are personal loans from lenders that work with bad credit borrowers. Use your credit as an untapped asset to consolidate debt. Since there is collateral as insurance that the loan will be paid the interest rates on unsecured loans are typically much higher than those you find attached to secure loans such as the mortgage of a home in which the house is collateral or.

Loans with Bad Credit. Clients who have remained with the companys program for 24 to 48 months averaged a debt reduction of 30 after fees. Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase.

Unsecured loans dont require collateral. Find competitive business debt consolidation financing rates and options Select. But this doesnt mean you cant consolidate your debt.

Interest rates fees and terms for these types. You cannot apply for a debt consolidation loan from. As with all loans debt consolidation loans also have some potential drawbacks to consider including.

Learn more about debt. Free no-obligation debt analysis. Debt consolidation combines credit card debt other bills into one monthly payment at a lower interest rate.

However with a debt consolidation loan you can start to repay your creditors while making positive steps towards ultimately improving your score. This means if you have poor credit you likely wont get approved for a debt consolidation loan from one of those financial institutions. This means fewer payments each month and lower interest rates.

Personal loans usually are unsecured meaning the. FreedomPlus is an indirect lending platform that offers personal loans underwritten by Cross River Bank or MetaBank. Within 72hrs you can receive a debt consolidation loan to pay off debt and streamline your financial obligations taking unnecessary financial pressure off your shoulders.

Debt Consolidation Loans. Read More Mortgage News. If you are overburdened with debt it is your option.

Youll typically need good to excellent credit to qualify for a debt consolidation loan a good credit score is usually considered to be 700 or higher. The 14 billion Chicago-based credit union founded in 1935 is one of the. If you have poor or fair credit it could be.

Also handles debt from personal loans private student loans lines of credit and collections. Compare unsecured personal loans from some of Australias top lenders. Some students with a poor credit score make the mistake of using a payday lender that charges a high interest rate and prepayment penalty to cover the cost of books and other living necessities.

Repayment terms range from 36 to 60 monthsor three to five years. Find the best deal on rates fees and features in seconds. Most personal loans are unsecured but banks and credit unions may offer personal loans secured by cash deposits and.

The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000. Fewer options for poor and fair credit.

These lenders may accept credit scores of 600 or even less. Specializes in credit card and medical debt. Debt Consolidation Loans For Bad Credit.

Universal Credit is an online lending platform that offers personal loans between 1000 and 50000 through its partners. When you apply for a loan and use it to pay off multiple other loans or credit cards. Axos has no prepayment penalty and funding is fast.

Debt Consolidation Loans. Banks and credit unions want debt consolidation loan applicants to have good credit. These can be secured backed by collateral or unsecured loans.

Often youll need a credit score of around 650 although bad-credit debt consolidation lenders exist.

Consolidating Credit Card Debt Without Hurting Your Credit

Debt Consolidation Loans Mortgages Poor Credit Loansforpoorcredit Payday Loans Home Improvement Loans Loans For Bad Credit

Don T Go Bust Borrowing Useful Credit Solutions Infographic No Credit Loans

Debt Consolidation Loans With Bad Credit Lexington Law

5 Best Debt Consolidation Loans For Bad Credit Rates Reviews Badcredit Org

Tumblr Loan Consolidation Debt Consolidation Loans Financial Quotes

Debt Ceiling Bumper Sticker Zazzle Debt Ceiling Debt Payoff Plan Debt Free

September 2022 S Debt Consolidation Loans For Bad Credit

Oz9ixf7ksqx3pm

15 Loan Sites For Bad Credit Sproutmentor Loans For Poor Credit Loans For Bad Credit Get Cash Fast

How To Get A Personal Loan In 2020 The Logic Of Money Personal Loans Bad Credit Personal Loans Loan

8 Debt Consolidation Loans For Bad Credit 2022 Badcredit Org

If You Need A Loan But Your Credit Isn T Great This Will Help You Find A Quick Bad Credit Loan Without Having No Credit Loans Loans For Bad Credit Need A

How To Get A Debt Consolidation Loan With Bad Credit

Bad Credit Debt Consolidation Loans Credello

Tumblr Good Credit Loans For Poor Credit Low Interest Personal Loans

There Are Plenty Of Bad Credit Loan Sites But Finding The Best Loans Means Findi Debt Relief Programs No Credit Loans Loans For Bad Credit