60+ banks lost money during the mortgage default crisis because

Of defaulted loans to investors in the mortgage-backed securitiesb. Web Banks and hedge funds made so much money selling mortgage-backed securities they soon created a huge demand for the underlying mortgages.

Housing Financing At The Crossroads Access And Affordability In An Aging Society Springerlink

Web M2 money supply will increase and the M1 money supply will decrease.

. During this crisis the lenders were the biggest culprits because they freely granted loans to people who could not. Web - homebuyers defaulted on mortgages held by the banks. Financial institutions decided to reduce their exposure to risk dramatically and banks hesitated to lend to each other.

Web were community banks often in parts of the country where the subprime mortgage crisis and the recession made real estate problems more severe than elsewhere. Web After the mortgage market froze in the 1930s and banks were unwilling or unable to continue lending the federal government intervened to bring stability to the national housing market. Web banks lost money during the mortgage default crisis becausea.

They held a mortgage-backed securities. Web Banks and investors began losing money. Answer the question on the basis of the following list of assets.

Market Discipline And Regulatory Arbitrage Evidence From Abcp Liquidity Guarantors Sciencedirect

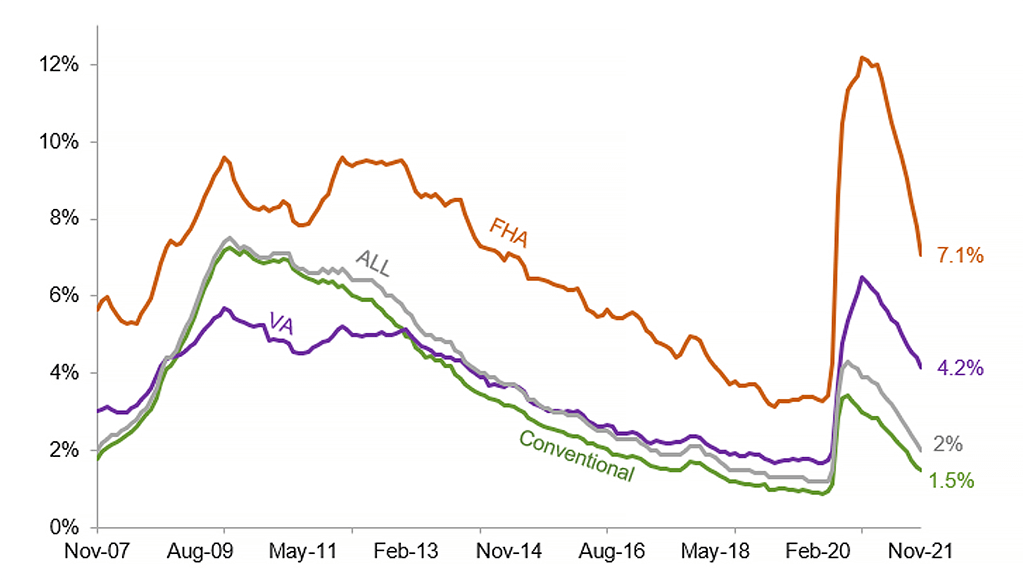

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

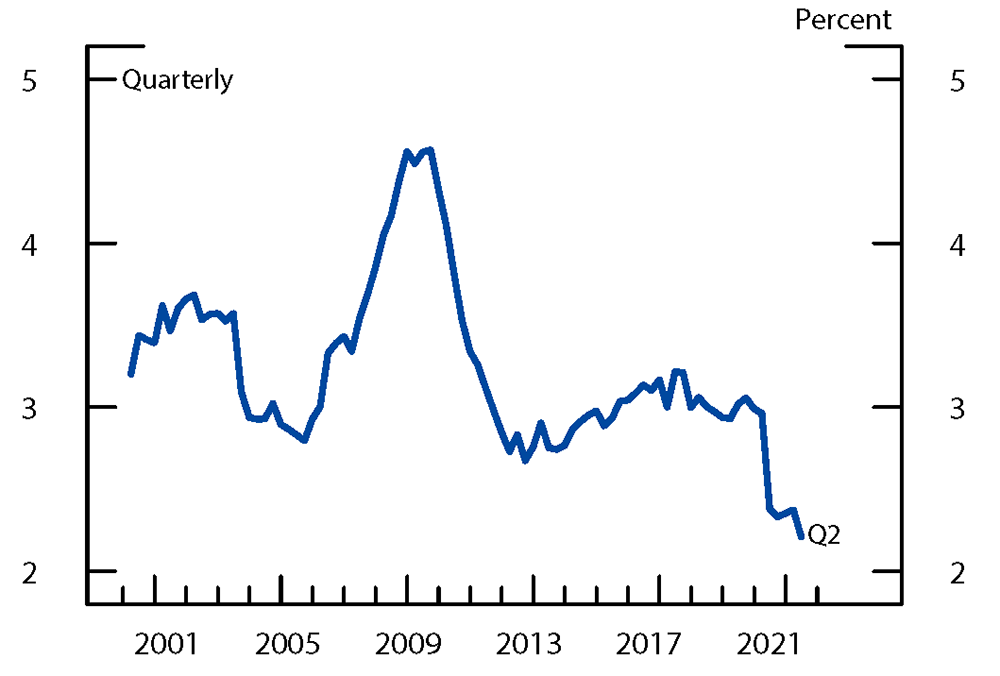

Serious Delinquency Rate For All Mortgage Loan Types Down From Last Year Corelogic

Mortgage Backed Securities Explained For Dummies Sa Shares

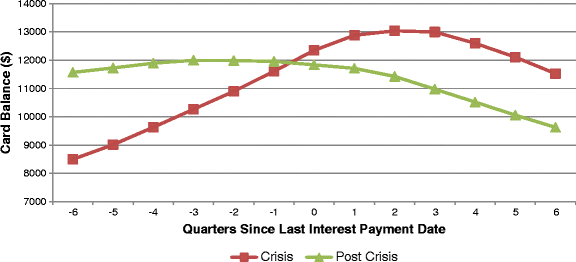

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

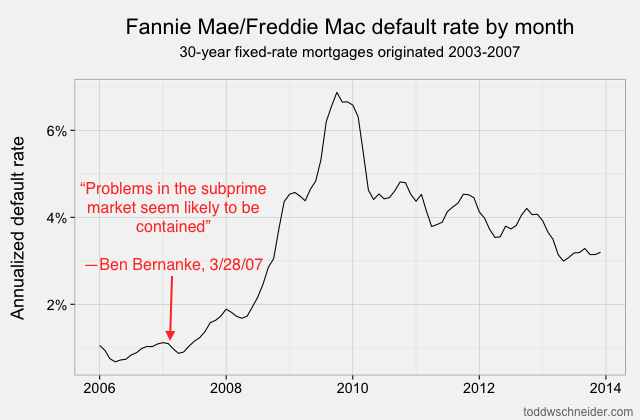

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Rbnz Banks Resilient To All But The Most Severe Scenarios Interest Co Nz

Treasury Rbnz Start Turning Their Attentions Towards Saving For The Next Rainy Day Interest Co Nz

Pdf Anticipating A Reverse Mortgage Adoption In Croatia

Horizon Kenya Exploring Trends Set To Shape The Future In Kenya

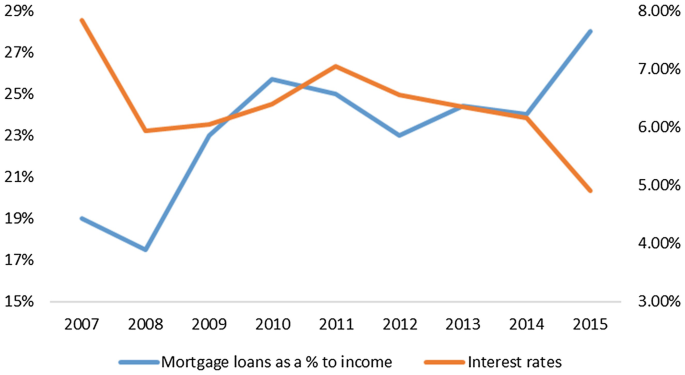

Czech Republic Staff Report For The 2018 Article Iv Consultation In Imf Staff Country Reports Volume 2018 Issue 187 2018

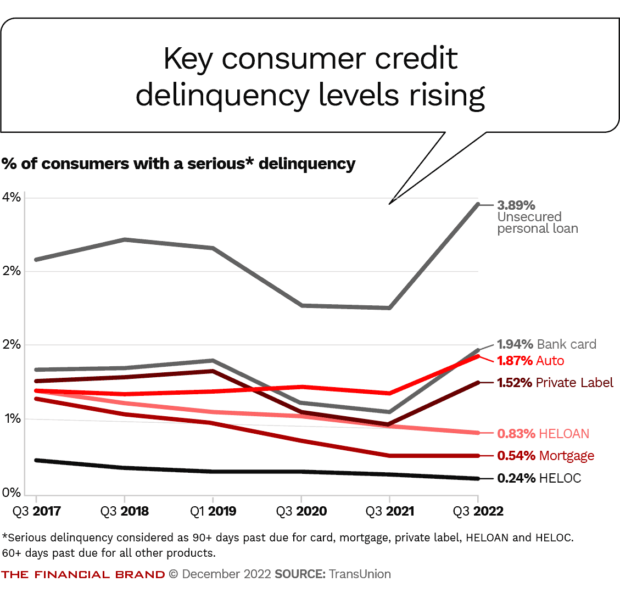

2023 Consumer Loan Trends High Demand Rising Delinquencies

Annual Report 2007 Erste Group

Era Of Stimulus Distorted Consumer Credit Ends Auto Loans Delinquencies Prime Subprime Wolf Street

Foreclosure Delay And Consumer Credit Performance Springerlink